Euromines President invited European Institutions and Automotive sector to jointly assess the realities of supply of raw materials to European manufacturers. His two statements summarize the past decade approach to raw materials in the EU: “For years Europe was far too complacent in outsourcing pollution – and receiving raw materials for our consumption in return” – and yet “Nowhere else mining is happening at such a high level of environmental protection as in Europe”.

From the rare earth crisis in the beginning of the 2000s, to the magnesium, gallium and germanium graphite crunch today – the intervals demonstrating European vulnerabilities are becoming shorter. The resulting dependency creates pressure on political leadership in the EU. European Institutions seem to have acknowledged this threat to competitiveness of the European industry. After all, the same materials are critical to achieving Green Deal made in Europe with or values, industry and society. Only by including all these aspects the green transformation can be a successful role model to copy for other countries.

In 1957, European leaders had the incredible foresight to make war economically impossible and eventually unthinkable. At the heart of it: integrating the production of raw materials across borders of countries, obliging them to work together. Across various economic crises, Europe calibrated a systemic prosperity and comfort by trading, finding allies and ensuring access to energy and non-energy commodities.

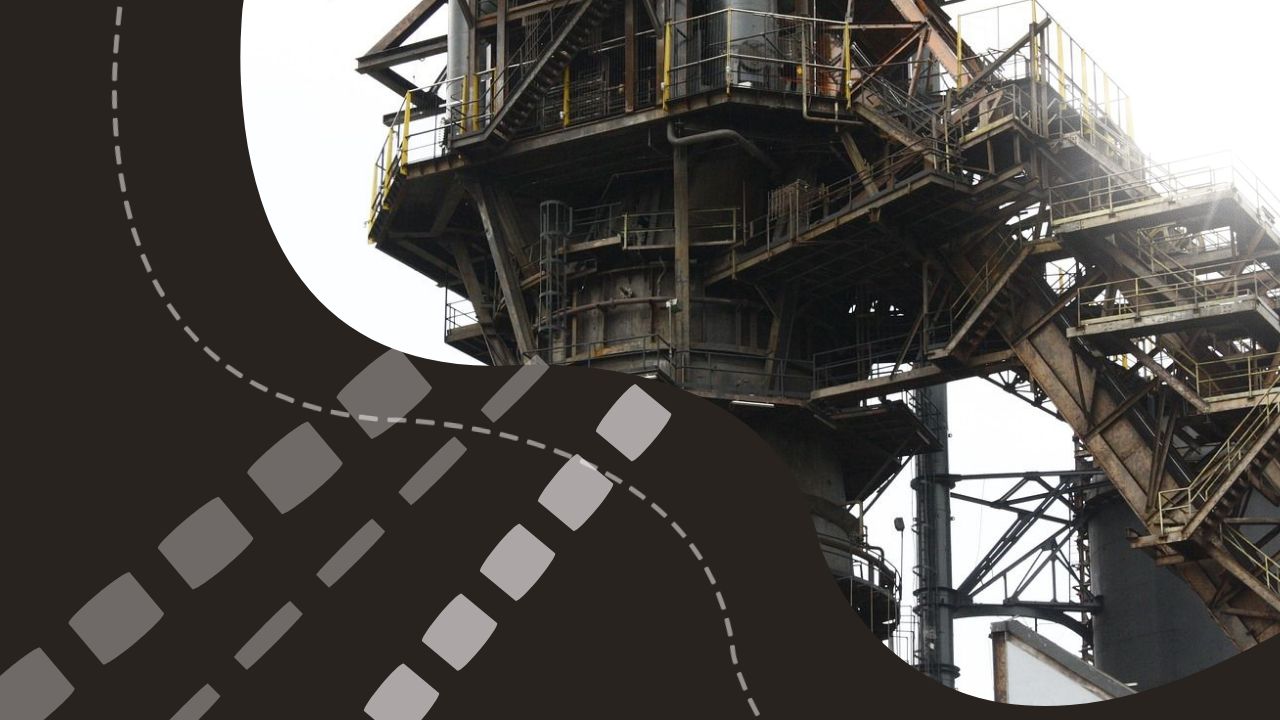

Today EU faces yet another challenge: climate change and the required energy, consumption and production transition, shift the rules of the game to a new level of fierce competition. War has returned to Europe, and it is not a given that allies and rivals alike step in for what Europe decided to outsource. Such increasing exposure is a serious to our prosperity and innovation power to find answers to the gargantuan task of tackling climate change.

ESG and geopolitical imperatives while maintaining prosperity will depend on a commodity transition: metals and minerals will fuel the planet. The demand increase for metals needed for goods such as e-vehicles and the infrastructure to make this work will be enormous – we cannot even fathom it. This requires bold steps in how we treat and use raw materials: not just specific in form of applications or technologies but systemic across value chains. After all, the sustainability impact of driving an e-vehicle depends on the sustainability performance of the raw materials it is made of.

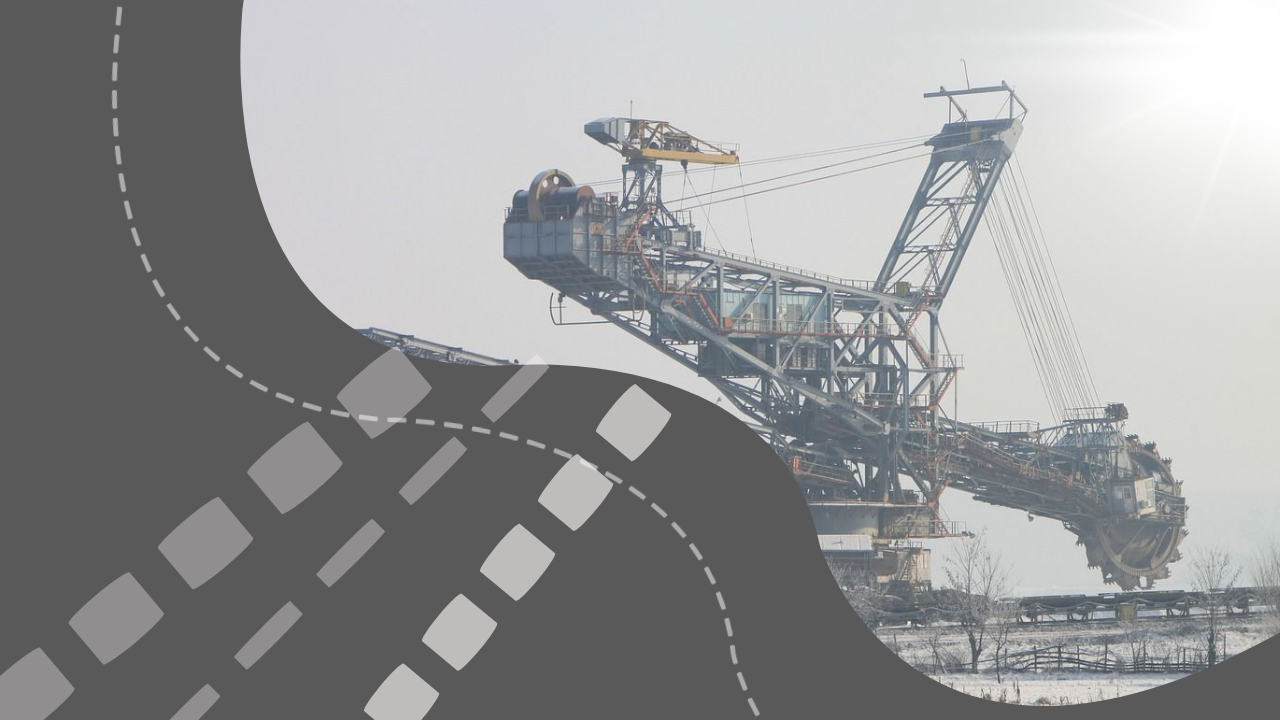

European mining emerges as a strategic linchpin for autonomy in green, digital, and defence sectors. It can provide the raw materials needed to make a wind turbine run and a battery to store this electricity, but also serve as a benchmark for ESG standards for imported materials.

Europe is not alone.

The EU’s Green Deal is not the only sustainability transition policy – the race for raw materials will intensify even more, scrambling to get access to the most promising deposits. Control over extraction rights and refining capacity will be the defining geopolitical challenge for the decades to come. Europe needs to reckon with this on three accounts:

Utilize Europe’s Resources: Europe must tap into its promising deposits for critical and strategic materials, utilizing the knowledge and expertise of EU mining companies with minimal environmental impact.

Build Sustainable Partnerships: Outsourcing to areas with lower regulatory requirements is not an option. Europe must engage in partnerships with allies willing to uphold high standards in environmental, social, and governance issues.

Circular Economy Integration: Beyond recycling, integrating mining into the Circular Economy concept can minimize primary raw material extraction for other sectors.

Redefining Raw Material Approaches.

Raw materials should no longer be considered merely a procurement issue. Confirming this disparity in approaches is the fact that for many sectors, supply of raw materials is sixth or seventh tier on their demand list. Yet, without securing the premium for the ESG criteria in sourcing them, the rift between downstream manufacturing and upstream mining companies will continue to render supply chains fragile, prone to disruptions and impede sustainability and human rights standards.

Extraction, refining, and manufacturing need to compete on more than “just-in-time” and cheapest prices. This behaviour change is a catalyst to do more in a sustainable way and be honest in how we source and procure raw materials to fulfil our own sustainability ambitions.

Sustainability is not an externality.

Internalizing high production standards in upstream and security of supply externalities in downstream industries must go hand in hand to recognize costs and benefits of a sustainable raw materials extraction. Mining as the base of many Green Deal objectives – if done right – decarbonizes entire value chains. LKAB’s pellets are 7 times less CO2-intensive than sinter production and key for decarbonized steel production. Boliden’s Aitik and Kevitsa mines are prime examples of mine electrification -providing low-carbon copper and zinc that are needed for electrification through increased deployment of fossil free electricity.

The EU raw materials mining industry has all the elements ready – from deposits, environmentally friendly extraction processes to a world-class R&D ambition to further reduce the impact of mining and providing critical and strategic raw materials. To make this happen Europe must act now! The Critical Raw Materials Act is a paradigm shift politically recognizing the benefits of our own backyard. The momentum initiated with the CRM Act must not be slowed down. There is a lot to do if we are serious about our role in the global green transition – starting with the production of our daily-life consumption.