According to Reuters, it’s time to scrutinize the feasibility of decarbonizing Asia’s vast and expanding steel sector. Reducing carbon emissions is possible but requires a phased approach over a longer-than-ideal period and only if incentives are provided. The steel industry, the world’s largest industrial source of carbon dioxide emissions, accounts for about 8% of global emissions, making efforts to decarbonize this sector crucial for achieving net-zero carbon goals.

This week, representatives from Asia’s iron ore and steel industries gathered in Singapore, revealing both encouraging and discouraging news about decarbonization efforts. The good news is that nearly every market player, from mining companies to steel mills, is taking the issue seriously, investing time, effort, and capital in finding solutions. The bad news is that achieving net-zero emissions by 2050 in Asia seems unattainable with current and foreseeable technologies.

Another significant obstacle is the current steel pricing structure. There is no real premium for producing low-carbon steel in Asia, and little indication of this changing soon. As it stands, mining companies and steel mills are mainly undertaking decarbonization efforts under voluntary commitments to reduce carbon emissions, driven by shareholder pressure, some government directives, and public demand to mitigate the expected negative impact of climate change.

While this is positive, it means that any costs incurred for decarbonization are effectively excluded from company profits since there is no financial reward for producing cleaner steel in Asia. The challenge is how to implement incentives for decarbonization, from relatively simple and low-cost initial steps to much more complex and capital-intensive ambitions for zero-emission steel production.

One potential approach is a multi-tiered incentive system. For example, the base level of carbon emissions might be set at 2.1 metric tons per ton of steel produced using the current method of smelting iron ore fines in a blast furnace followed by a converter. If a steel plant could reduce emissions by one-third, it might be rewarded with a carbon credit or avoid paying a carbon tax of a set amount per ton of reduced emissions.

Suppose this initial reduction costs $60 per ton, roughly the price of a carbon credit in the European Union. If a steel plant can cut emissions by another third through investments in new processes like using direct reduced iron (DRI) or its transportable equivalent, hot briquetted iron (HBI) in an electric arc furnace (EAF), this reduction could be rewarded with a higher carbon price, say $120 per ton.

The final steps towards fully decarbonizing steel production using green hydrogen to produce HBI, clean electricity to run EAFs, and eco-friendly shipping fuels like methanol for transporting materials might attract even greater carbon credits to offset the substantial capital required to achieve this.

STIMULI NECESSARY

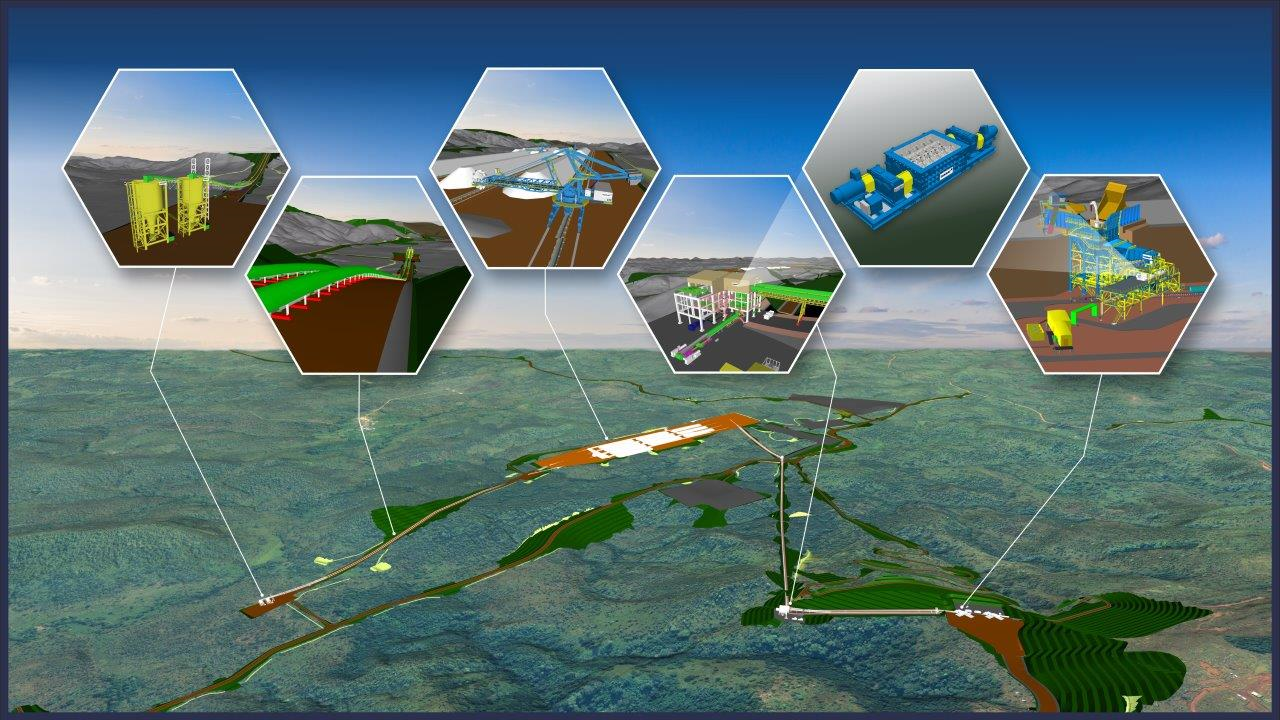

Presentations at this week’s Green Steel Forum in Singapore made it clear: without incentives, only the initial and relatively simple steps towards decarbonization will become a reality. These include maximizing the efficiency of basic oxygen furnaces, increasing the use of higher-quality iron ore and agglomerates like DRI and HBI, boosting the use of recycled steel in EAFs, and decarbonizing iron ore mining by limiting diesel power at remote mines and electrifying vehicles and trains.

The problem is that these efforts are likely to reduce only about 20% of global steel emissions. Further steps include using natural gas to process low-grade iron ore into DRI and HBI for use in more advanced converters or even EAFs, then transitioning this process to green hydrogen. This is where costs become significant, and shareholders are likely to question the benefits.

Ultimately, to push steel decarbonization beyond the low-hanging fruit, a pricing incentive is needed, and the market alone is unlikely to provide this, as costs will likely outweigh climate concerns for most consumers. This necessitates implementing policies like carbon taxes or carbon credits, ideally coordinated across many countries, particularly the largest iron ore exporters—Australia, Brazil, and South Africa—as well as China, which produces half of the world’s steel, and new major producers like India.