Colin Moorhead, managing director of Xanadu Mines, has joined the ranks of industry experts foreseeing a potential commodity “supercycle,” as copper prices surge by nearly 15% over the past year. Speaking on the “On the Couch” podcast series dedicated to providing insights into the investment landscape, Moorhead emphasized the enduring significance of copper compared to other commodities.

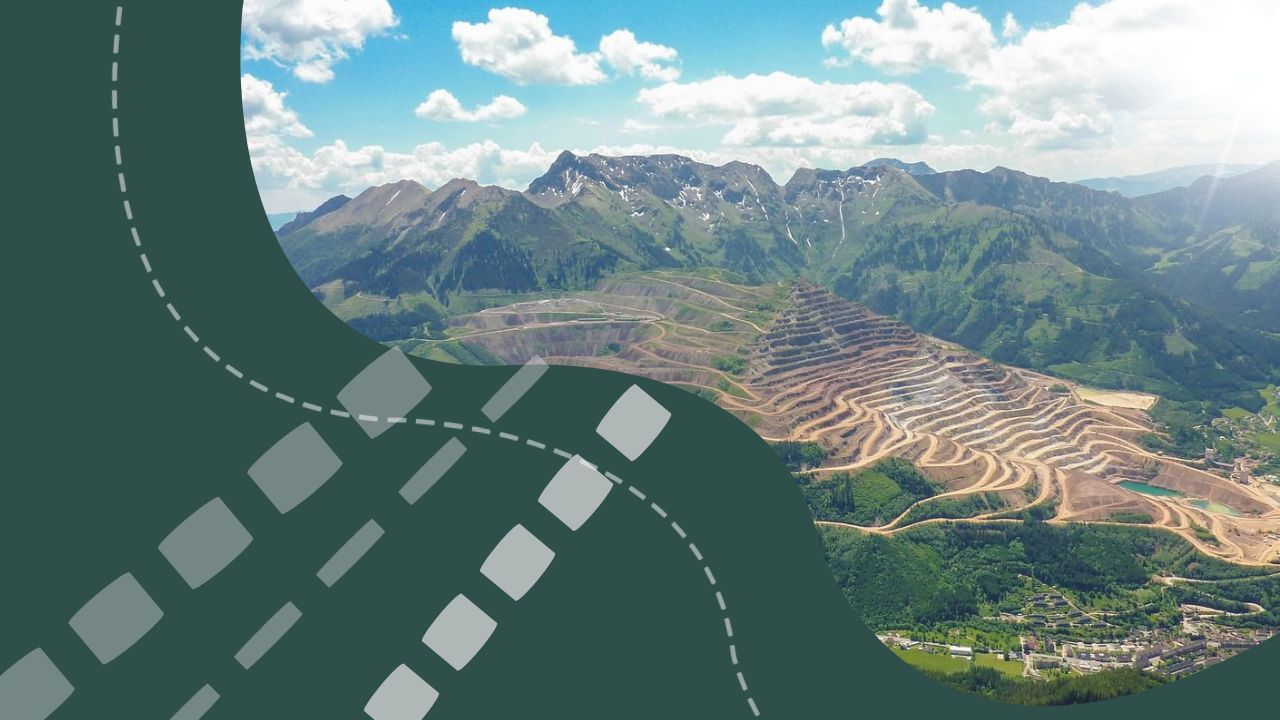

Xanadu Mines’ flagship Kharmagtai project, situated in Mongolia, boasts a substantial mineral resource estimated at 1.3 billion tonnes, with copper content at 0.3% and gold at 0.2g/t. Notably, the resource includes 52 million tonnes of oxide material, predominantly within the top 20 meters from the surface.

The current spot price for copper hovers around $14,700 per tonne, while gold maintains a price of approximately $3500 per ounce.