Zijin Mining, a prominent Chinese mining company, announced its ambitious plans on Wednesday to enhance copper and gold operations in Serbia, aiming to position the Balkan nation as the primary copper producer in Europe. Chen Jinghe, the chairman of Zijin Mining, revealed the company’s strategy to achieve an annual production target of at least 250,000 tonnes of copper and 10 tonnes of gold from its Serbian operations, indicating a slight increase from the previous year. Emphasizing a shift towards underground mining development, Chen articulated the company’s future investment direction during a press briefing.

Zijin Mining, renowned for its significant contributions to the gold and copper industry in China, solidified its partnership with Serbia’s RTB Bor mining operation in 2018. The move aligns with China’s broader economic engagement in Serbia and neighboring Balkan countries, reflecting Beijing’s concerted efforts to expand its economic influence across central and eastern Europe. The increasing significance of China to Serbia’s economy was underscored by the country’s Minister of Trade, who ranked China as Serbia’s second most vital economic partner after the EU. This sentiment anticipates a potential visit by Chinese President Xi Jinping later in the year.

In terms of trade, Chinese-owned enterprises emerged as dominant exporters in Serbia, with Zijin Mining leading the pack, followed by Zijin Copper and the HBIS group. Together, these entities accounted for a notable share of Serbia’s total exports, contributing approximately 8.7 percent to the country’s export revenue in the previous year. Furthermore, Serbia witnessed a substantial influx of foreign investment in 2023, with China emerging as the foremost investor, injecting 1.37 billion euros into various sectors, consolidating its position as a key economic stakeholder in the nation.

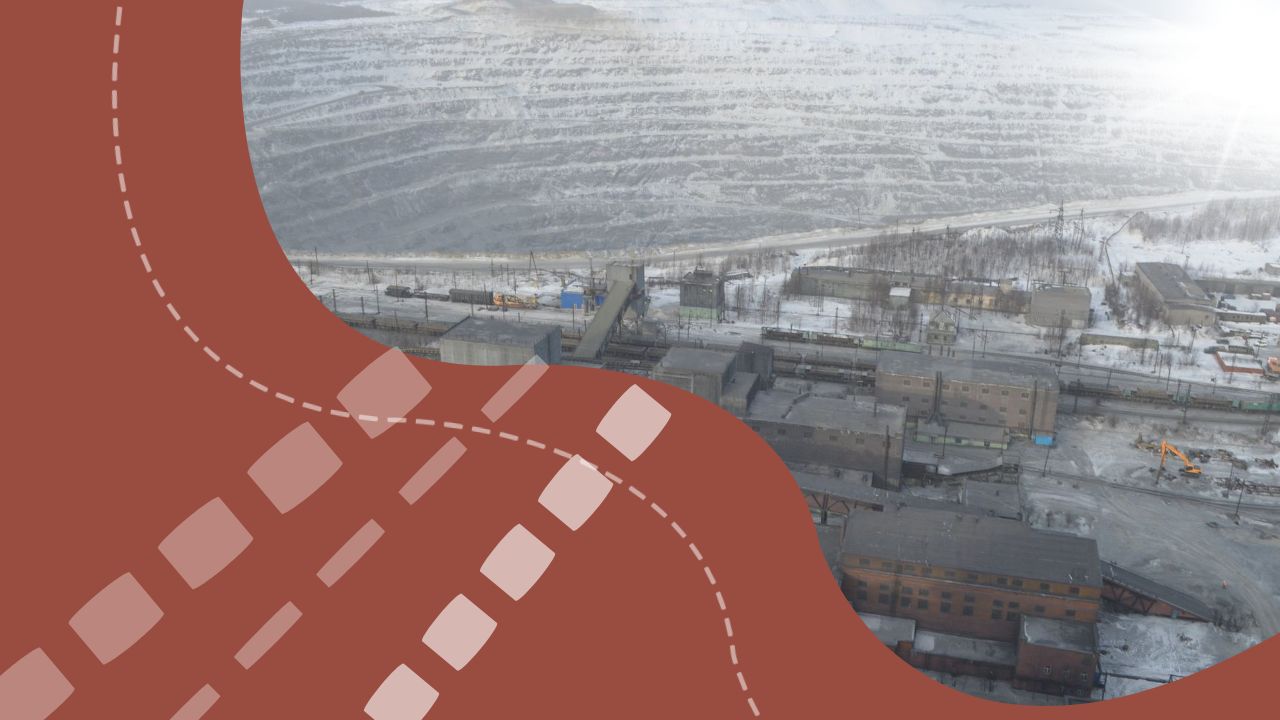

However, amidst governmental praise and economic advancements, communities residing near the expansive mining facilities in Bor have voiced persistent opposition to the projects, staging protests since January. Demonstrations frequently disrupt local transportation routes, reflecting ongoing tensions surrounding environmental concerns and community welfare.