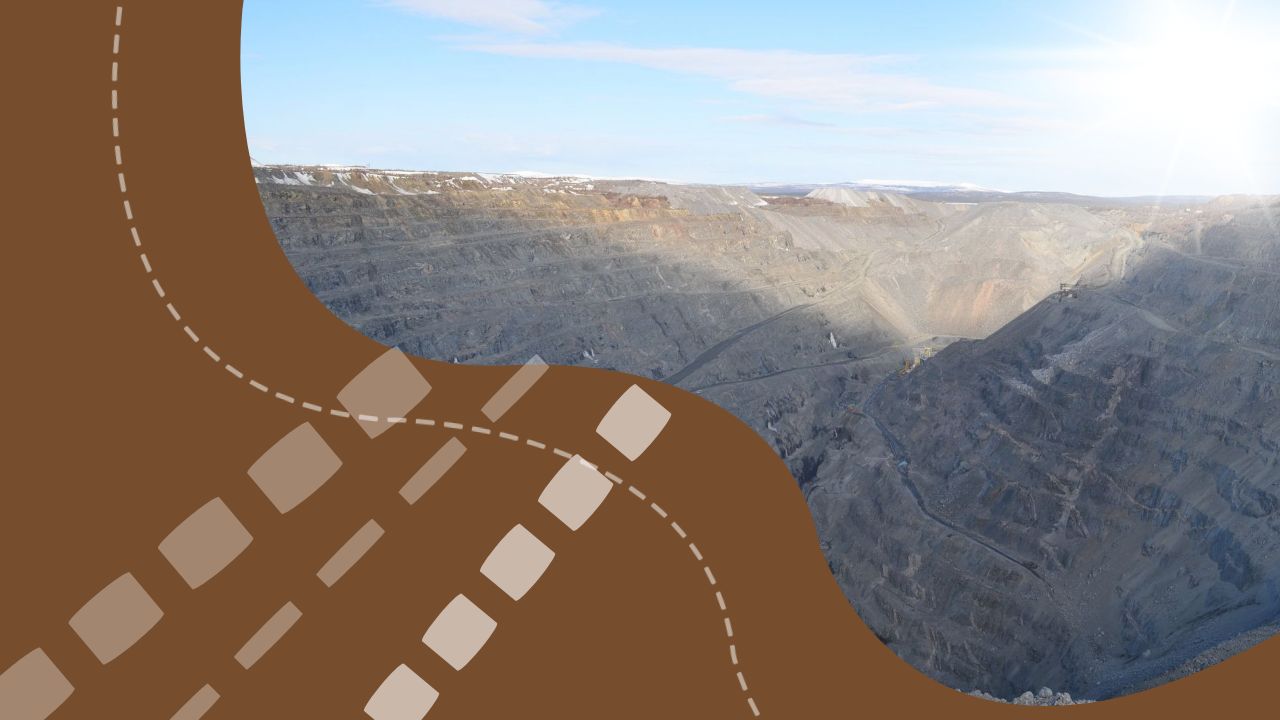

The Ireland Strategic Investment Fund (ISIF) has revealed a €30 million investment in an Irish fund dedicated to mining ventures. The recipient of ISIF’s investment is the Irish Minerals Fund, supported by Lionhead Resources, a private equity firm specializing in mining investments. The focus of the fund will be to pursue minority stakes in environmentally sustainable mining projects within the Republic of Ireland.

The Irish Minerals Fund’s investment strategy will prioritize projects with established mineral deposits, particularly those centered around zinc extraction. Nick Ashmore, ISIF’s director, emphasized the significance of the investment in promoting responsible mineral extraction, highlighting its potential to bolster indigenous businesses and create skilled jobs, particularly in rural areas.

Finance Minister Michael McGrath echoed these sentiments, noting the historical significance of the mining sector in Ireland and the potential for job creation in regional areas.

Lionhead Resources, based in London and South Africa, specializes in investments that support the transition to a low-carbon economy and the needs of a rapidly urbanizing global population.

The investment coincides with the European Union’s recent approval of the Critical Raw Materials Act (CRMA), aimed at reducing dependence on Chinese dominance in critical mineral supply chains, particularly for technologies essential to energy transition such as electric vehicles and renewable energy.