Kazakh authorities announced on August 22nd that a political decision has already been made regarding the departure of the company “ArcelorMittal Temirtau” (AMT) from the Republic, and negotiations are underway with the shareholders. According to some information, one of the potential buyers could be the Russian mining and metallurgical company “Severstal.” “Kursiv” interviewed experts and found out to whom else AMT assets could be sold and for what amount.

The reason for discussions about the fate of AMT was the accident on August 17th at the “Kazakhstanskaya” mine (owned by AMT), where five miners died. Following this, Kazakh authorities and the public began to question AMT’s presence in Kazakhstan. President Kasym-Zhomart Tokayev cast doubt on AMT’s continued stay in the country. Kazakhstan’s Prime Minister Alihan Smailov stated that the owners of the enterprise are to blame for the tragedy in the AMT mines. He mentioned that after a similar incident a few years earlier, AMT management had assured that they would do everything to ensure industrial safety, labor safety, and investment in production modernization. However, according to the Prime Minister, these commitments were not fully fulfilled.

In September 2021, AMT signed a memorandum of understanding with the government of Kazakhstan, under which AMT was supposed to invest at least $3 billion over the next 10 years. Smailov expressed outrage that people continue to die in AMT facilities, leading to the question of changing ownership of the enterprise.

Over the years, AMT has seen more than a hundred miners lose their lives at the company. “Kursiv” compiled a chronology of major tragedies that have occurred in the metallurgical company’s mines. The highest level of injuries and deaths occurred at KarMet, under whose management the “Kazakhstanskaya” mine, where five miners died, is located.

On Tuesday, August 22nd, the Minister of Finance, Erulan Zhamauvayev, told journalists that the authorities are negotiating with AMT shareholders about their departure from Kazakhstan, and a political decision on this matter already exists. Zhamauvayev added that the first Deputy Prime Minister of Kazakhstan, Roman Sklyar, is handling negotiations with potential buyers.

“Negotiations on a large enterprise should be conducted by specific individuals because it should be a serious negotiating process. Therefore, if everyone comments on it at their own level incompetently, it will be wrong. Moreover, it can affect the negotiation process. Therefore, the statement has already been made. I think there is a political decision (regarding the departure of ArcelorMittal from Kazakhstan), so we will work on it,” Zhamauvayev assured.

What risks does Mittal’s withdrawal from Kazakhstan pose?

Financial analyst Andrey Chebotarev doubts that the departure of Lakshmi Mittal from Kazakhstan will be quick and straightforward. The expert claims that Kazakhstan could face another Anatol Stati (an entrepreneur from Moldova) situation, where legal battles have been ongoing for years.

“To begin with, it is necessary to understand the exit strategy of the current investor. I sincerely hope that the situation with the current shareholder will be resolved quickly and painlessly. I hope that the path of aggressive nationalization will not be chosen, as it could deter future investors from Kazakhstan. We must demonstrate as smoothly, transparently, and openly as possible that the current investor violated investment agreements, failed to fulfill them, and that’s why the contract is being terminated. Not because we want a piece of the pie. I really hope that the desire for quick victories does not threaten our investment climate,” says Chebotarev.

Political analyst Petr Svoik, also known as the initiator of political integration between Kazakhstan and Russia, explains that in the event of Lakshmi Mittal’s departure from Kazakhstan, two major problems arise concerning the fate of KarMeta (Karaganda Metallurgical Plant owned by “ArcelorMittal Temirtau”). First, KarMeta currently operates within Mittal’s global network of enterprises and serves as a supplier of raw materials to other productions. After Mittal’s departure, Kazakhstan will lose these supplies and will have to reorient to something else. Second, the plant has been operated to its limits to extract profits from Kazakhstan.

“Let’s not deceive ourselves. If we sold it to a foreign investor in the first place, they are interested in not investing foreign money into the Kazakh plant but in extracting as much as possible to increase profits, including through savings on labor costs and modernization, as we have observed. The new buyer, in addition to solving the issues of integrating KarMeta’s products into other supply chains, must also find a substantial amount of money to upgrade KarMeta,” the expert claims.

Who can buy AMT assets? According to Chebotarev’s opinion, Kazakh companies, although technically capable of acquiring such assets, are unlikely to be interested. AMT requires significant investments, the analyst added.

“This is a rather heavy asset that requires a lot of investment. Furthermore, it’s unclear at what stage the current investor will exit. Therefore, I believe it will be some kind of strategic foreign investor or a consortium of investors under someone’s unified management,” the expert expressed.

Russian financial group “Finam” analyst Alexey Kalachev doubts the feasibility of Severstal’s purchase of AMT. According to him, Severstal has not expressed a willingness to acquire foreign assets, even in “friendly” jurisdictions.

“ArcelorMittal” is an international corporation. Therefore, for such transactions, it likely needs to obtain many approvals, including from regulators in unfriendly-to-Russia countries. Alexey Mordashov, who controls Severstal, is under sanctions that also apply to the companies he controls. Such a deal may simply not receive the necessary approvals from European regulators, Kalachev believes.

In turn, Petr Svoik believes that Severstal is a “principled candidate” as a potential buyer of AMT assets. “Samruk-Kazyna” could be an “intermediate option” in terms of transitional management, the political scientist added.

“FNB is in debt, deep in foreign currency debt. So, who could help it deal with its debts? This is a bad option unless it’s forced. As for Severstal, it’s more realistic. The burden of being under sanctions is as much a problem as it is a solution. As part of Russia’s policy to regain its technological sovereignty, there is certainly a task to completely reorient black and non-ferrous metallurgy toward its own market or the markets of friendly countries,” says the political scientist, adding that KarMet can be equipped with more technologically advanced products for the Russian, local, and Chinese markets.

Financial analyst Rasul Rysmambetov is not sure that AMT will be transferred to “Samruk-Kazyna” because the fund lacks the expertise and authority to manage such large projects. He explained that “Tau-Ken Samruk” (a unit of “Samruk-Kazyna”) does not interfere in the operations of mining and metallurgical companies in which it holds stakes but is either a minority shareholder or anchor investor. Rasul Rysmambetov also mentioned an approximate amount for which AMT could be sold.

“It could cost around $100 million. But there will also be Due Diligence because the expenses are very high. I would deduct from the price the miners who suffered and are receiving payments. In any case, the amount will be significant,” the expert noted.

According to him, the Kazakh authorities announced a tender for the purchase of AMT through Minister Zhamaubaev.

“There are Chinese, Indians, and Russians with Severstal. It’s hard to say which of them is more likely. I think this is not a matter of two weeks but one or two months,” Rasul Rysmambetov believes.

Financial analyst Arman Beisembaev also named China and India among potential buyers. However, he claims that if Mittal manages to acquire this asset, it will be handed over to the Russians, not directly but through various “intermediary” companies or a series of funds.

“Somebody will buy it, and the ultimate beneficiary will be unclear because they could fall under sanctions, and Kazakhstan is also afraid of that. But it is highly likely that the ultimate beneficiaries will be Russians. I cannot say that this is bad for Kazakhstan from an economic point of view. For example, Russian ‘EuroChem’ has been operating in Kazakhstan for many years, and ‘Kazatomprom’ also has a share of Russia [the company has joint ventures with ‘Rosatom’ structures],” Arman Beisembaev said.

He reminded that after the full-scale Russian invasion of Ukraine in 2022, the neighboring country began losing the European market. Now they are trying to reorient themselves to the East and South.

“Russia’s economic and political strategy is imperial in terms of economic behavior. It expands its sphere of influence. Since it practically lost the European market, it failed to take Ukraine, and Belarus is practically in its pocket. The nearest strategy is Kazakhstan,” the expert explains.

According to Beisembaev, his assumptions are based on the volume of Russia’s external investments. Until 2014, Russia invested the most in Ukraine – about $17 billion, with most of this money going to Kiev and the Kiev region. After 2014, Russia began investing the most in Kazakhstan, the analyst claims.

“Russia acts towards Kazakhstan exactly as it did towards Ukraine before 2014 – it employs soft power, economic influence, investments, and asset acquisition. Russians are already in ‘Kazatomprom,’ coal, uranium, and gas industries. The strategy is exactly the same as with Ukraine, and if we object, war is guaranteed,” Arman Beisembaev believes.

The analyst notes that AMT assets are “quite attractive,” so Kazakhstan can sell them with a premium and make a good profit. However, the buyer will have to invest in infrastructure and security, which will naturally be included in the contract terms and will affect the final cost. “I can’t say how much, but it depends on the will of the state. No investor wants to invest in security unless they are required to,” the analyst concluded.

The Failed Deal Between Severstal and Arcelor

In May 2006, the international company Arcelor S.A., at that time one of the world’s largest steelmaking companies, announced a merger with the Russian metallurgical company Severstal, owned by Alexey Mordashov. He was supposed to receive 295 million issued shares of Arcelor, equivalent to 32% of the share capital. In return, Arcelor would have received from Mordashov all his shares in Severstal (82%), including Severstal North America, mining assets, and a stake in the Italian company Lucchini. Additionally, Mordashov was to pay 1.25 billion euros. This deal was intended to thwart the plans of Arcelor’s acquisition by Lakshmi Mittal’s company, Mittal Steel. Currently, Lakshmi Mittal’s fortune is estimated at $16.1 billion.

However, just a month after reaching an agreement with Mordashov, Arcelor and Mittal Steel agreed to merge and expressed opposition to Severstal’s purchase of a stake, even though Mittal’s proposal to Arcelor had been considered hostile before. Thus, Arcelor and Mittal Steel formed the company ArcelorMittal, the world’s largest metallurgical company.

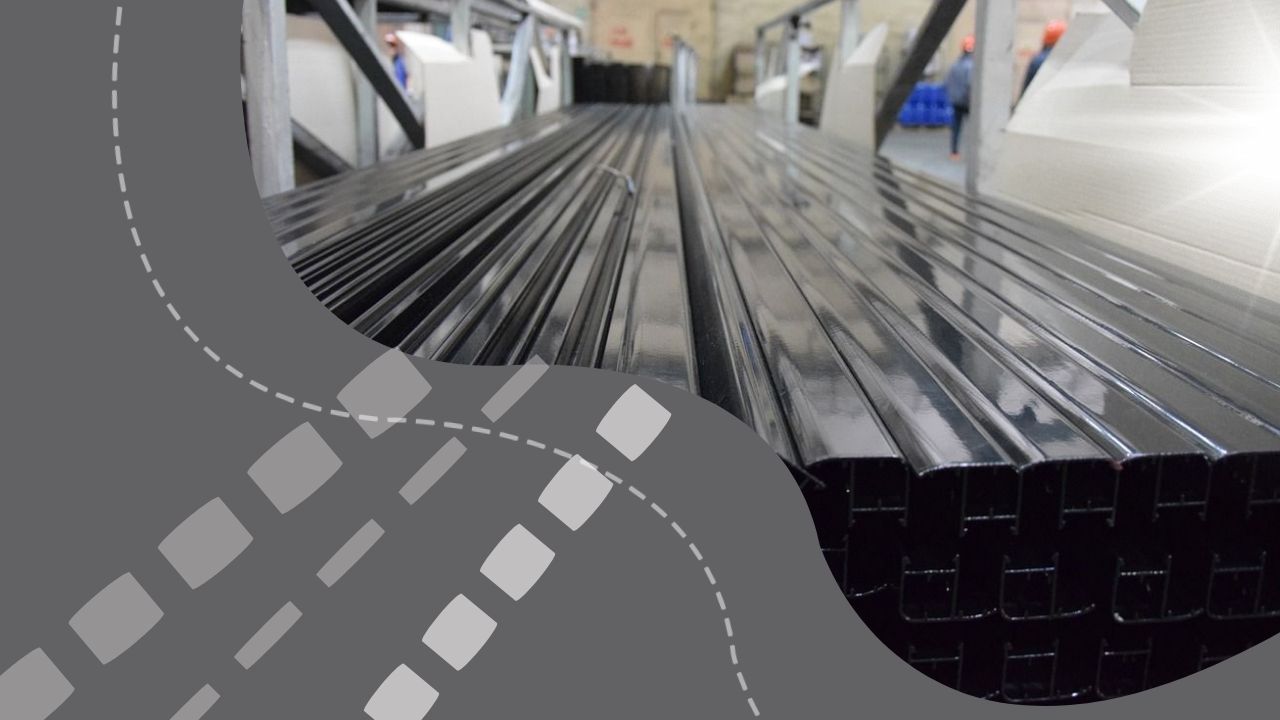

ArcelorMittal owns the steelmaking and mining company ArcelorMittal Temirtau in Kazakhstan. AMT is one of the largest enterprises in the Karaganda region, traditionally accounting for 25% of the total industrial production output. The sole shareholder of AMT is ArcelorMittal Holdings B.V., a public company registered in the Netherlands.