Erdene Resource Development Corp (TSX:ERD, OTC:ERDCF) CEO Peter Akerley joined Steve Darling from Proactive to share news the company has announced the results of an updated independent Feasibility Study for the open-pit Bayan Khundii Gold Project in southwest Mongolia.

Akerley telling Proactive the numbers have been much improved including after-tax Net Present Value of 170 million (NPV5%) and 35.3% Internal Rate of Return, increasing to US$196 million and 38.95% IRR, respectively, at the current gold price of US$1,900/oz.

Life of Mine Earnings Before Interest, Taxes and Depreciation of US$451 million, increasing to US$495 million at a US$1,900/oz gold price. Total recovered gold of 476,000 ounces, a 25% increase compared to the 2020 Feasibility Study from an average gold recovery rate of 93%.

Measured and Indicated Resources of 674,700 ounces of gold at an average grade of 2.6 g/t gold, and 319,000 ounces of silver at an average grade of 1.38 g/t silver. The company also sees room for growth with adjacent high-grade resources and recent discoveries provide a high probability for expansion.

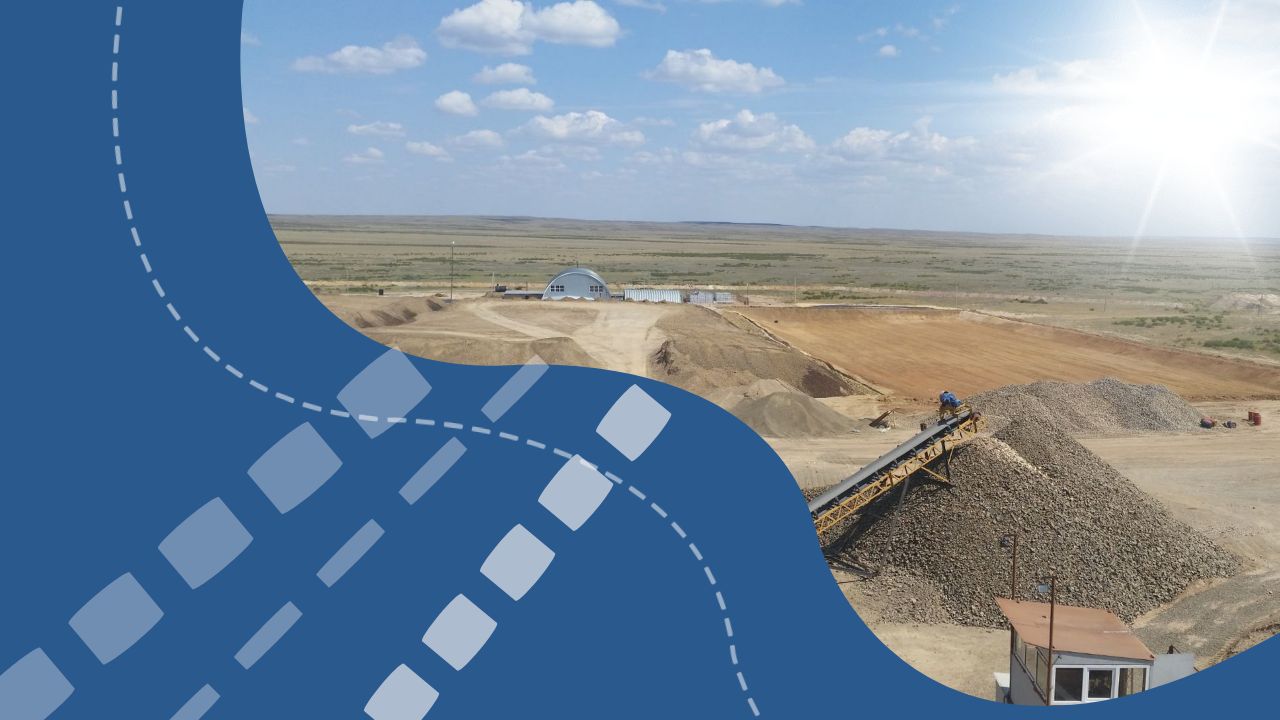

The company, with its strategic alliance with MMC, Mongolia’s largest independent miner, is moving towards production. Early construction works are underway with the first gold and cash flow expected in 2025.