The shifting sands of Kazakhstan’s mining sector were the focus of a recent British-Kazakh Society (BKS) webinar, bringing together legal experts, industry professionals, and policymakers to dissect the impacts of evolving government regulations. Held on 13 November 2025, the discussion revealed a concerning trend of increasing investor uncertainty, despite the country’s rich geological potential.

Land Barriers Continue to Hamper Investment

Kazakhstan’s crucial mining sector is undergoing significant changes, grappling with persistent land access issues and the introduction of new tax policies. A presentation by Almat Daumov, Partner at GRATA International in Almaty, shed light on these challenges and proposed solutions, highlighting both potential hurdles and opportunities for investors.

Kazakhstan’s crucial mining sector is undergoing significant changes, grappling with persistent land access issues and the introduction of new tax policies. A presentation by Almat Daumov, Partner at GRATA International in Almaty, shed light on these challenges and proposed solutions, highlighting both potential hurdles and opportunities for investors.

Despite seemingly swift issuance of exploration licenses for solid minerals (within 3-4 weeks), actual investment is frequently stalled by complex land-access barriers. Daumov emphasised that establishing servitude over private land for exploration can cause delays of 9-18 months. Even more critical, “akimats” (local executive bodies) are reportedly refusing compulsory land acquisition for mining projects deemed “non-state” in nature, citing budget limitations.

Drawing on international experience, Daumov pointed to successful models in Australia, Canada, and Mexico, where simplified (notification-based) land-access procedures for exploration and government expropriation of land for public necessity (including mine development) are common.

Proposed Solutions for Land Access:

To address these issues, Daumov proposed key solutions:

- Exploration: Akimats should establish public servitudes on both state and private land, as permitted by Article 69 of the Land Code.

- Mining: Mine development should be consistently recognised as a public need (Article 84). He stressed the need for unified interpretation and practice by akimats. Furthermore, to alleviate the state budget burden, Article 87 should be amended to ensure compensation is paid directly to the subsoil user, not the state.

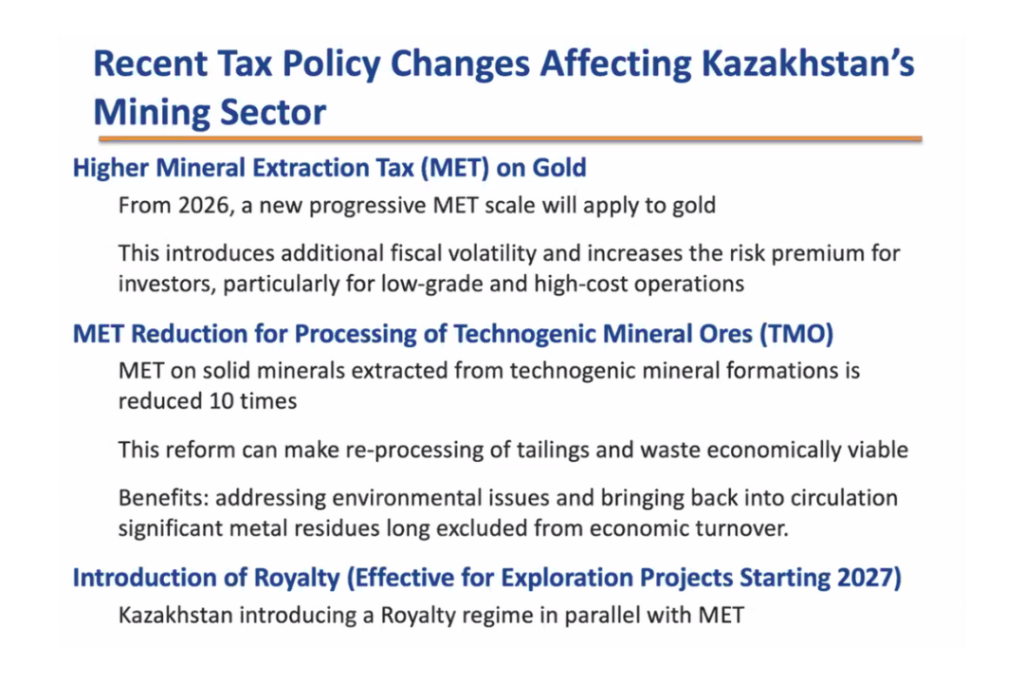

New Tax Policies Introduce Volatility and Opportunity

Beyond land access, Kazakhstan’s mining sector is also navigating significant tax policy changes.

Higher Mineral Extraction Tax (MET) on Gold:

Starting in 2026, a new progressive MET scale will apply to gold. This change is expected to introduce additional fiscal volatility and increase the risk premium for investors, particularly those involved in low-grade and high-cost operations.

MET Reduction for Technogenic Mineral Ores (TMO):

In a more positive development, the MET on solid minerals extracted from technogenic mineral formations will be reduced tenfold. This reform aims to make the re-processing of tailings and waste economically viable. The benefits are twofold: addressing environmental issues and bringing significant metal residues, long excluded from economic turnover, back into circulation.

Introduction of Royalty Regime:

Effective for exploration projects starting in 2027, Kazakhstan will introduce a Royalty regime in parallel with the MET. Current proposed royalty rates are 7% for metals and alloys, 10% for concentrates, and 13% for ores, raising concerns among industry stakeholders.

Daumov’s analysis underscores a critical period for Kazakhstan’s mining sector. While the government aims to streamline processes and introduce new revenue streams, the effectiveness of these reforms will largely depend on clear implementation and a willingness to address investor concerns regarding both land access and fiscal predictability.

Kazakhstan on the Investment Attractiveness Index

Daniel A. Witt, President of the International Tax and Investment Center (ITIC), painted a picture of mixed signals for potential investors. While Kazakhstan has achieved its goal of being a top 50 most competitive country globally (ranking 34th in the 2025 IMD World Competitiveness Report), the micro-picture in the mining sector is less favourable.

Witt cited the Fraser Institute Annual Survey of Mining Companies (2024), noting a significant drop in the country’s Policy Perception Index (PPI) score—the metric heavily influenced by government control over tax, legal, and regulatory parameters.

“Kazakhstan came in 59 [on the Investment Attractiveness Index]. They fell… 59 is just barely passing,” stated Witt, stressing that the key challenge remains building a stable, predictable, and transparent fiscal and regulatory regime to attract large-scale international mining projects, similar to the success seen in the oil and gas sector. Specific concerns raised included the complexity of the tax system, difficulties obtaining VAT refunds, and the need for mechanisms to share risk between the state and investors.

Policy Trends and Regulatory Erosion

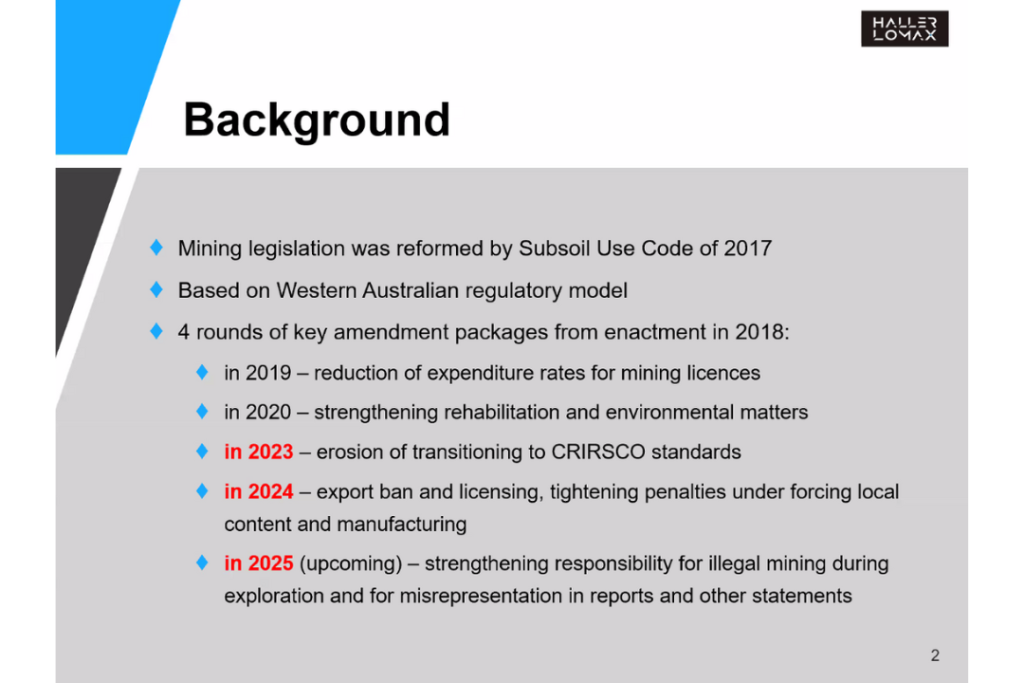

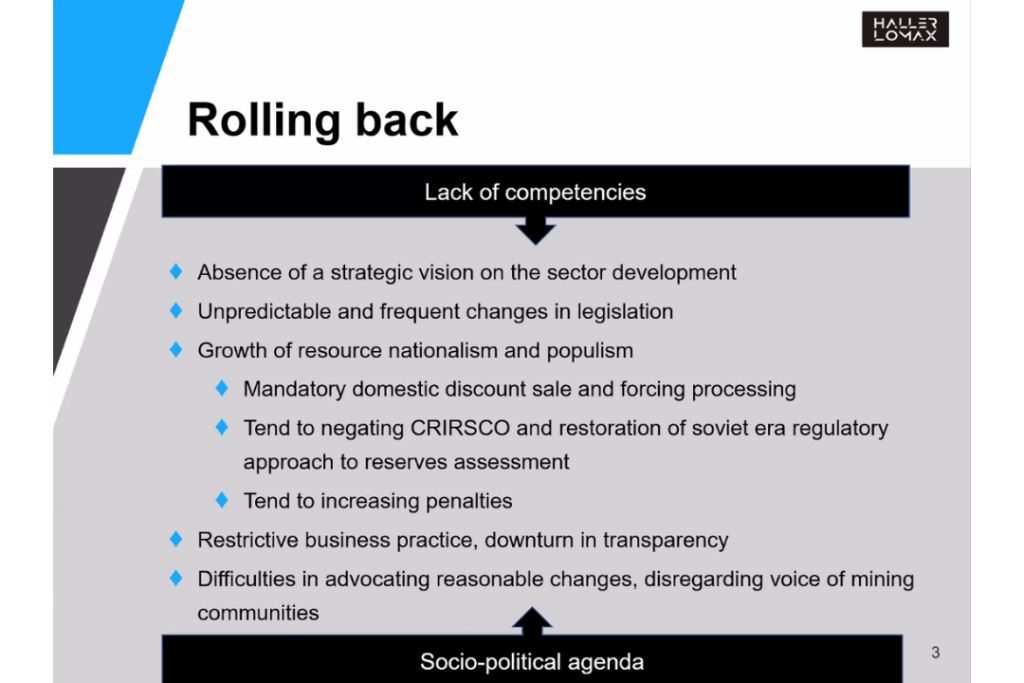

Timur Odilov, Founding Partner at Haller Lomax highlighted a worrying erosion of reforms designed to align Kazakhstan with international standards.

Odilov noted that following the adoption of the Western Australian-based Mining Code in 2017, subsequent years have seen the re-emergence of stricter rules and instability, particularly since 2023. Key changes discussed included:

- Erosion of CRISCO Standards: Discussions in parliament have begun challenging the transition to international reporting standards, favouring a return to Soviet-era standards.

- Resource Nationalism: Increasing pressure for mandatory domestic discount sales and forced processing, even for materials that cannot be domestically processed (such as certain rare earths).

- Uncertainty and Lack of Strategy: The policy shifts are driven by a mix of socio-political agendas and a perceived lack of “institutional memory” or a holistic strategic vision for the sector’s long-term development.

Olga Petrova, Rio Tinto Exploration Kazakhstan Country Manager, affirmed this trend, stating that while the government continues to express interest in attracting investment, the actions—such as increasing land access costs for explorers—are “a little different,” appearing as a short-term win that ignores long-term losses.

Olga Petrova, Rio Tinto Exploration Kazakhstan Country Manager, affirmed this trend, stating that while the government continues to express interest in attracting investment, the actions—such as increasing land access costs for explorers—are “a little different,” appearing as a short-term win that ignores long-term losses.

Investment Opportunities and Future Outlook

Despite the challenges, the webinar underscored the vast potential of Kazakhstan’s mining sector. With abundant geology and a strategic location, Kazakhstan is well-positioned to become a global leader in critical minerals. However, to attract investment, the government must address policy risks, ensure property rights, and create a stable regulatory environment.