In a recent Fox Business segment, Cove Capital Chairman and CEO Pini Althaus emphasized the growing urgency to reduce reliance on China for critical minerals—a dependence he described as “just not tenable anymore.” As geopolitical tensions escalate and supply chain vulnerabilities come into sharper focus, Althaus highlighted the importance of securing domestic sources of rare earth elements and other essential materials vital to modern industries, including technology, defense, and renewable energy.

The discussion centered around two key developments: Ukraine’s mineral deal and Cove Capital’s joint venture in the Akbulak rare earth project. These initiatives underscore a broader global effort to diversify supply chains and reclaim control over resources that are indispensable to economic and national security.

The Strategic Importance of Critical Minerals

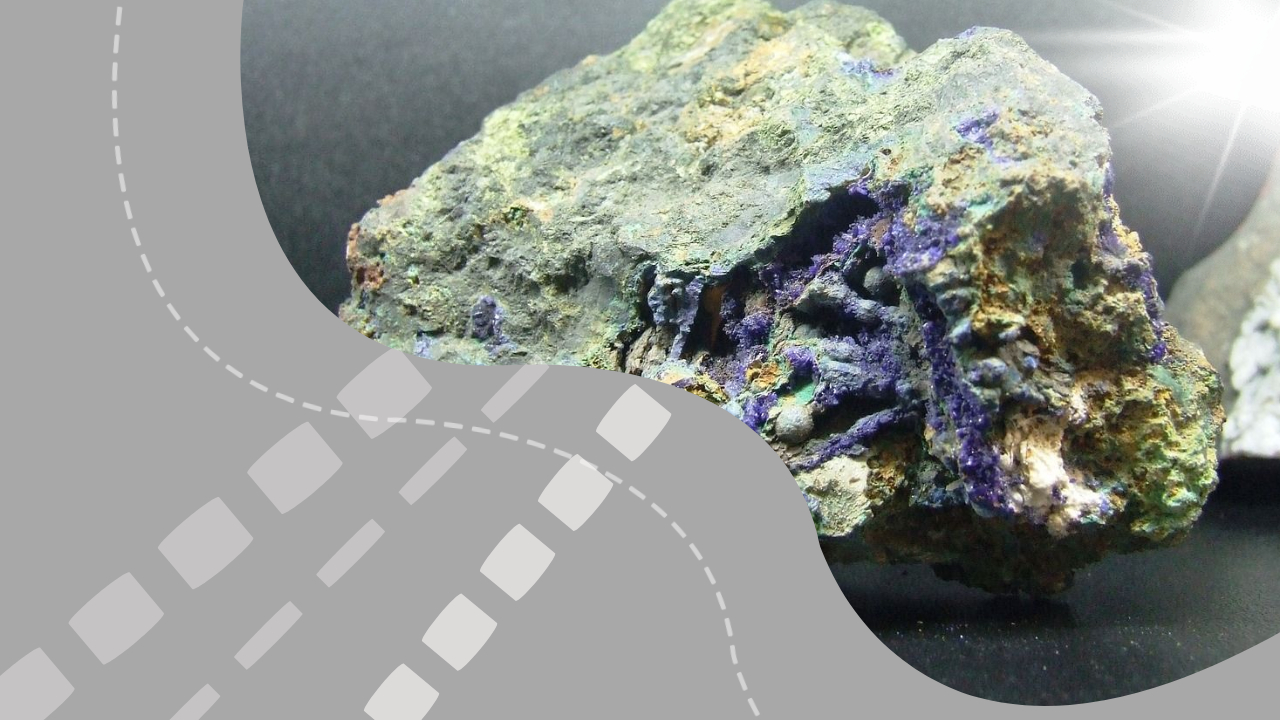

Critical minerals, such as neodymium, lithium, cobalt, and dysprosium, play an indispensable role in manufacturing everything from smartphones and electric vehicles to advanced military equipment like guided missiles and radar systems. However, China currently dominates the global market for these materials, controlling approximately 60% of mining operations and nearly 90% of processing capacity worldwide.

This heavy reliance on China has raised alarms among U.S. policymakers and business leaders, particularly amid escalating trade disputes and concerns about Beijing’s influence over strategic industries. Althaus warned that depending on a single country for such crucial inputs poses significant risks, especially during times of geopolitical instability or conflict.

“The world is waking up to the fact that we cannot continue outsourcing our critical mineral needs to China,” Althaus said during the interview. “It’s not just about economics—it’s about sovereignty and ensuring that we have access to the resources necessary to sustain our technological and industrial leadership.”

Ukraine’s Mineral Deal: A Step Toward Diversification

One promising development discussed in the segment was Ukraine’s recent agreement to explore and develop its vast mineral reserves. The Eastern European nation is believed to hold substantial deposits of titanium, uranium, and other critical minerals, which could help alleviate Europe’s—and by extension, the West’s—dependence on Chinese imports.

Althaus praised the deal as a “game-changer” for regional supply chains, noting that it represents a proactive step toward building alternative sources of critical minerals outside of China’s orbit. By investing in Ukraine’s mining sector, Western nations can simultaneously support Kyiv’s economic recovery while advancing their own strategic interests.

“This isn’t just about helping Ukraine rebuild—it’s about creating a more resilient and diversified global supply chain,” Althaus explained. “Every ton of critical minerals produced in Ukraine is one less ton we need to source from China.”

Cove Capital’s Joint Venture in Akbulak

Another focal point of the conversation was Cove Capital’s involvement in the Akbulak rare earth project, located in Kazakhstan. Through a joint venture with local partners, the company aims to extract and process rare earth elements from one of Central Asia’s most promising deposits. If successful, the project could provide a significant boost to non-Chinese supplies of these vital materials.

Althaus described the Akbulak initiative as part of a larger mission to establish a reliable, ethical, and geopolitically stable source of critical minerals. He stressed the importance of adhering to high environmental and labor standards throughout the extraction process, contrasting this approach with some of the questionable practices associated with Chinese mining operations.

“We’re not just focused on producing these minerals—we’re committed to doing so responsibly,” Althaus stated. “That means minimizing environmental impact, respecting workers’ rights, and fostering long-term partnerships with host countries.”

Why Domestic Production Matters

The push for greater self-sufficiency in critical minerals comes at a pivotal moment for the United States and its allies. With the Biden administration prioritizing clean energy technologies and Congress passing legislation like the Inflation Reduction Act—which includes incentives for domestic battery production—the demand for critical minerals is expected to surge in the coming years.

However, without secure access to these resources, America’s transition to a green economy could face significant hurdles. Althaus pointed out that relying on foreign suppliers, particularly those tied to adversarial regimes, undermines efforts to achieve true energy independence.

“If we want to lead the charge in renewable energy and advanced manufacturing, we need to take ownership of our supply chains,” he argued. “That starts with investing in domestic projects and forging alliances with trusted partners who share our values.”