Glencore, the global trading company, has decided to retain its 70.2% stake in the Kazakh mining business after failing to agree on a sale price, according to “Kursiv” citing Bloomberg. Glencore has been simplifying its operations by divesting smaller or non-core assets. The decision to sell its Kazakh assets was made in early summer when Chinese buyers showed interest. This included the Vasilkovsky gold mine, managed by KazZinc.

Potential investors were unable to meet Glencore’s price expectations, which Bloomberg estimates to be several billion dollars. As a result, the company opted not to proceed with the sale. Under existing rules, investors can acquire a part of the enterprise only if the other partner declines the purchase. The co-owner of KazZinc, Tau-Ken Samruk (holding a 29.8% stake), has not commented on the potential deal.

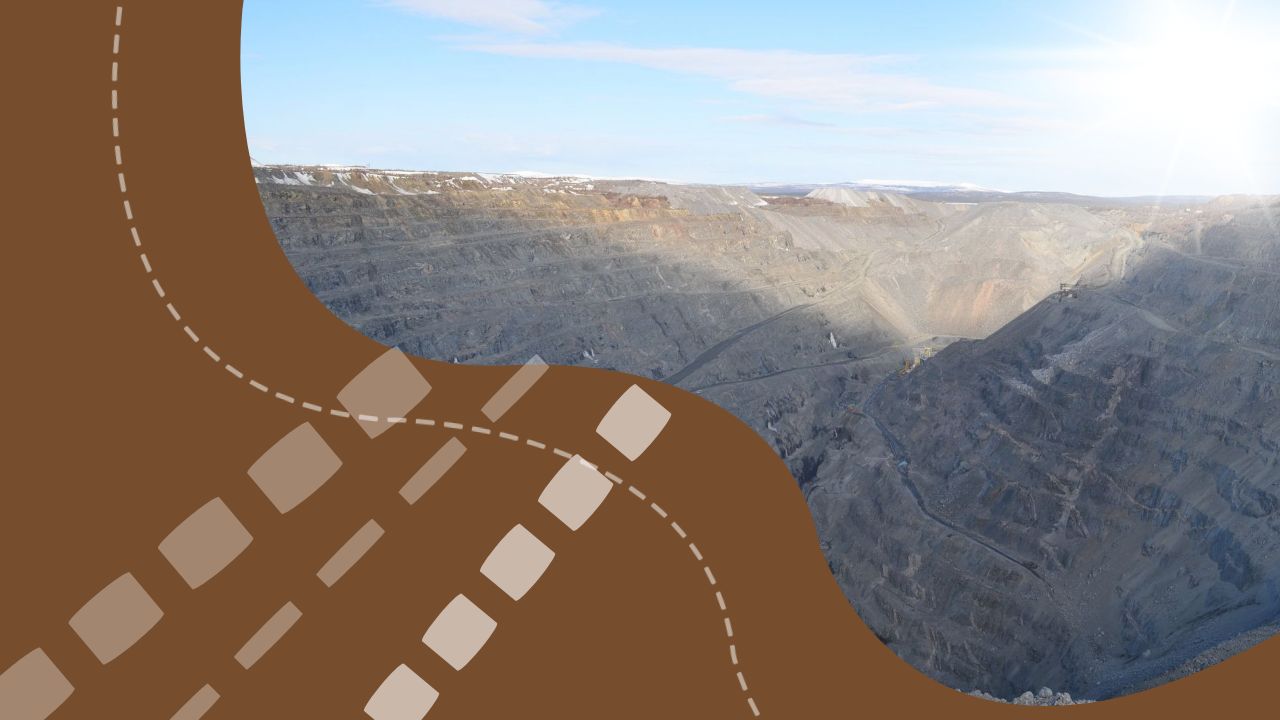

KazZinc is a major producer of non-ferrous metals. According to Glencore, last year the enterprise produced 173,900 tons of zinc, an increase of 27,500 tons from the previous year. Additionally, in 2023, KazZinc produced 35,600 tons of lead, 14,800 tons of copper, and 598,000 ounces of gold.