Steel giant ArcelorMittal has concluded the divestment of its Kazakh steel and mining business to state-run direct investment fund Qazaqstan Investment Corporation (QIC).

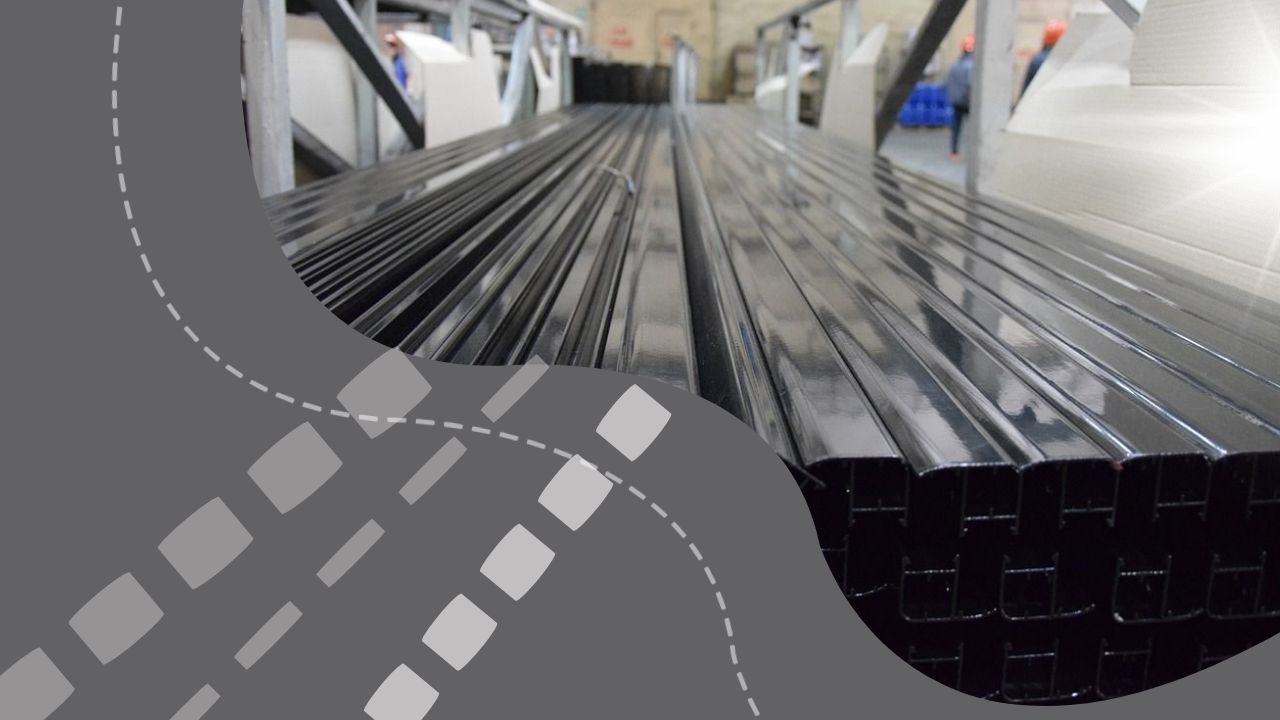

The transaction saw the company selling a 100% interest in ArcelorMittal Temirtau and ArcelorMittal Tubular Products Aktau (together called ArcelorMittal Temirtau).

The steelmaker secured $286m for the sale and another $250m as repayment of outstanding intra-group dues.

It will also secure a further $450m in sovereign-fund guaranteed payment as intra-group loan repayment. This will be made in four equal annual tranches.

ArcelorMittal said that the deal had a negative effect on its equity of nearly $800m.

As of 30 September 2023, the company had valued the ArcelorMittal Temirtau assets at $1.8bn.

This sale was executed on an ‘as is’ basis, with QIC taking full control and accountability for ArcelorMittal Temirtau. The acquired operations will be rebranded.

The company has owned as well as operated the Kazakh steel plant and integrated iron-ore coal mines since 1995.

It had been in negotiations with the Government of Kazakhstan for some months now.

This follows a fire incident this October at the company’s Kostenko coal mine in the Karaganda region.

Triggered by a methane gas explosion, the incident claimed the lives of 45 people.

Kazakhstan president Kassym-Jomart Tokayev ordered a halt on investment cooperation with the steelmaker after the incident and confirmed a preliminary agreement with the company regarding the nationalisation of the Kazakh business.

The plans for ownership transfer to the government came after a spate of incidents at ArcelorMittal’s mines, including one in 2006 that led to the deaths of 41 miners.

The Kazakh Government is now looking to foster a conducive environment for the business’ long-term financial and operational stability and define its sustainable future.

Besides, the company donated $35m to the Qazaqstan Halqyna charitable foundation to fund healthcare and education projects in the Karagandy region.

ArcelorMittal executive chairman Lakshmi Mittal and CEO Aditya Mittal said: “We would like to take this opportunity to thank the employees of ArcelorMittal Temirtau for everything they have contributed over the past 28 years.

“While the business faced some serious challenges, there were also many notable achievements, which should be a source of pride. ArcelorMittal Temirtau was a very valued part of ArcelorMittal, and we leave with respectful memories of Kazakhstan and all those who partnered with us.”